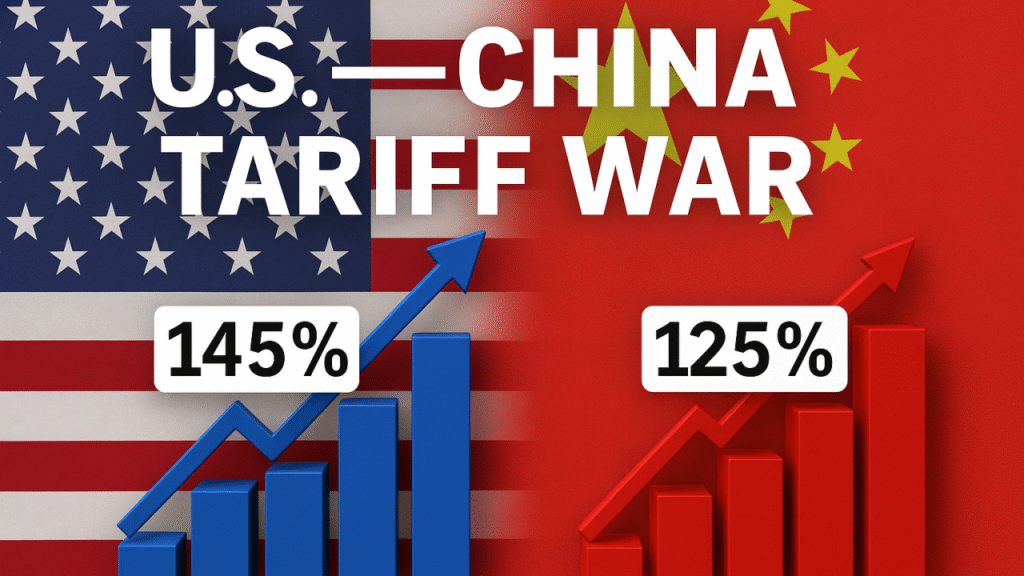

Trade tensions between the United States and China have reignited sharply in October 2025. After a relatively uneasy calm, both sides have announced escalations: new tariffs, export controls, port fees, and retaliatory measures. This renewed standoff highlights how fragile the trade détente was, especially when critical resources and strategic industries like rare earths, high tech, and shipping are involved.

Below is a breakdown of the recent developments, the claims and counterclaims from both nations, likely consequences, and what could unfold in the weeks ahead.

Recent Escalations: What Changed in October

1. U.S. Announces 100% Tariff on Chinese Imports

On October 10, 2025, U.S. President Donald Trump declared that the U.S. would impose an additional 100% tariff on Chinese imports, effective November 1 (or sooner depending on China’s response).

This would be layered on top of existing tariffs already in place. Trump also announced new export controls on critical U.S.-made software.

2. China Restricts Rare Earth Export & Retaliates with Port Fees

China moved preemptively, imposing export controls on rare earth minerals and strategic materials resources vital to electronics, defense, and clean energy sectors.

In addition, China announced retaliatory port fees on U.S.-linked vessels docking in Chinese ports, effective October 14. The scheme levies fees per voyage, up to a limit of five voyages per year.

On the same day, the U.S. began imposing its port fees targeting China-linked ships, escalating a maritime front in the trade dispute.

3. Diplomatic Moves & Talks

The U.S. Treasury Secretary Scott Bessent confirmed that talks are underway with China to de-escalate the trade tensions.

Meanwhile, the backdrop of these moves involves the impending APEC summit, where a meeting between Trump and Xi Jinping was expected but now faces uncertainty.

What the U.S. Says: Justifications & Arguments

From the American perspective, several arguments underlie the recent tariff hikes and export controls:

From the American perspective, several arguments underlie the recent tariff hikes and export controls:

A. “Unfair Trade & Supply Chain Risks”

The U.S. accuses China of using export restrictions and subsidies to dominate critical supply chains especially in rare earths, semiconductors, and high-tech materials. Trump’s administration frames the 100% tariff as a necessary countermeasure to China’s “very hostile” policies.

B. “Maritime Dominance and Port Fees”

In statements related to port fees, the U.S. argued that China’s maritime practices, state-backed shipping conglomerates, and logistic dominance have distorted global trade. The U.S. port fee on Chinese vessels is part of a push to push back against such structural advantages.

C. “National Security & Technology Controls”

The export controls on critical software are being positioned as national security measures efforts to prevent China from acquiring advanced U.S. tech that could be used in military or dual-use applications.

D. “Domestic Consumers Will Benefit Long-Term”

In public messaging, U.S. officials argue that though tariffs can raise short-term costs, long term the tariffs help rebuild American manufacturing, reduce dependence on foreign supply chains, and protect strategic industries. Analysts, however, warn that U.S. consumers may bear much of the cost.

Treasury Secretary Bessent also suggested the initial restrictions may have originated from lower-level Chinese decisions and insisted constructive dialogue is still viable.

What China Says: Responses & Rebuttals

China has not remained quiet. Its responses have combined retaliation, defiance, and a call for diplomacy.

China has not remained quiet. Its responses have combined retaliation, defiance, and a call for diplomacy.

A. “Tariff Threats Are Discriminatory & Violative of Trade Norms”

China’s Commerce Ministry condemned the U.S. over the 100% tariff threat, accusing Washington of applying double standards and harming global trade order.

The port fees on U.S. vessels were described as countermeasures to “discriminatory practices” harming China’s shipping industry.

B. “We Do Not Seek Conflict, But Are Prepared to Respond”

China framed its position cautiously: it says it does not aim to provoke a trade war but will take “resolute measures” to defend its interests if pushed.

A spokesperson said, “We do not want a tariff war, but we are not afraid of one.”

C. “Open to Negotiation, If the U.S. Retracts Threats”

China has called for the U.S. to withdraw its tariff threats and resume constructive engagement. Its public statements emphasize that diplomacy remains possible, but only if the U.S. reverses “erroneous practices.”

Broader Impacts & Consequences

The October escalation in tariff hostilities is unlikely to remain contained. Some broader implications:

1. Disruption to Global Shipping & Trade Routes

With both nations employing port fees on each other’s vessels, shipping costs may rise, freight routes may adjust, and global trade flows could become distorted.

2. Inflation & Consumer Burden

Recent analysis warns that U.S. consumers may shoulder 55% of the tariff burden, with further upward pressure on prices—especially in electronics, machinery, and intermediate goods.

3. Technology & Supply Chain Contagion

Because rare earths and strategic components are central to semiconductors, defense, EVs, and green tech, restrictions can ripple across global supply chains and slow innovation globally.

4. Market Volatility & Investor Uncertainty

The announcements triggered sharp stock market declines, especially in tech sectors, revealing how sensitive global capital flows are to trade escalations.

5. Risk to Diplomatic & Multilateral Forums

The standoff may jeopardize planned high-level meetings (such as at APEC), and make multilateral cooperation (climate, trade, development) more difficult amid rising distrust.

What to Watch Next

-

Will the Trump–Xi meeting at APEC still proceed, or be canceled altogether?

-

Can both sides step back from full-scale escalation and return to negotiation?

-

How strongly will third-party nations (EU, India, Japan) position themselves?

-

Will the U.S. Supreme Court rulings on tariff authority (e.g., on IEEPA) influence future actions?

-

Will Chinese export controls expand further, perhaps targeting other strategic minerals or tech inputs?

The October 2025 spike in the U.S.-China tariff confrontation throws the trade relationship into fresh turbulence. What began with export controls on rare earths quickly escalated into 100% tariff threats, port fees on ships, and reciprocal retaliation.

Each side insists their moves are defensive, rational, and necessary; yet the economic risk is real to consumers, global supply chains, and diplomatic stability. Whether this months’ flare-ups cool into a new modus vivendi or spiral into a sustained trade war remains to be seen. To know more update subscribe Jatininfo.in now.